Welcome to our comprehensive guide on High Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs). If you’ve ever wondered how to make healthcare more affordable, or how to get more control over your medical expenses, then this post is for you.

Navigating the world of healthcare can often be a complex journey, filled with jargon and options that are difficult to compare. Among the myriad of choices, High Deductible Health Plans (HDHPs) stand out as a unique category. Understanding what makes a plan an HDHP can empower you to make more informed decisions about your healthcare coverage.

High Deductible Health Plans are a type of health insurance plan that, as the name suggests, come with a higher deductible compared to traditional health insurance plans. A deductible is the amount you pay for covered health care services before your insurance plan starts to pay. With HDHPs, you’re responsible for more of your upfront healthcare costs, but you’ll generally pay lower monthly premiums.

An HSA is a tax-advantaged savings account that allows you to set aside money specifically for qualified medical expenses. It pairs exclusively with HDHPs, offering a way to manage the higher costs that come with these plans. The money you deposit into an HSA is tax-deductible, and withdrawals for qualified medical expenses are tax-free.

While HDHPs might seem daunting due to the higher out-of-pocket costs, when paired with an HSA, they offer a powerful financial tool that can benefit you in both the short and long term. Imagine being able to save money pre-tax, grow those savings tax-free through investments, and then use that money tax-free for qualified medical expenses. It’s like a triple tax advantage that can add up to substantial savings over time.

Stay tuned as we dive deep into eligibility criteria, benefits, investment options, and how to strategically use your HSA funds to cover healthcare costs while growing your savings.

Definition and Features of HDHPs

An HDHP is a health insurance plan with a higher deductible compared to traditional insurance plans. A deductible is the amount you must pay out-of-pocket for covered healthcare services before your insurance starts covering costs. In an HDHP, this deductible is notably higher, but in return, the plan usually offers lower monthly premiums. The idea is to give you more responsibility for your initial healthcare expenditures in exchange for more affordable ongoing costs.

HDHPs often come with the following features:

The specific criteria that define an HDHP can vary slightly from year to year due to adjustments in healthcare laws and inflation. In 2024, a plan must meet the following requirements to qualify as an HDHP:

If a health plan meets these criteria, it is considered an HDHP and can be paired with a Health Savings Account (HSA), offering you a holistic approach to managing healthcare expenses.

An HSA is a tax-advantaged savings account designed specifically to help you cover qualified medical expenses. These accounts pair exclusively with HDHPs, offering you a financial cushion to manage higher out-of-pocket costs. Unlike a regular savings account, the money in an HSA can grow through interest or investments, providing additional financial leverage for future healthcare needs.

The primary purpose of an HSA is twofold:

HSAs come with impressive tax advantages that can substantially maximize your healthcare savings:

In summary, HSAs offer a triple tax advantage—pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified expenses—that can significantly benefit your financial planning, both for immediate healthcare costs and long-term savings.

Opening a Health Savings Account is a straightforward process, but choosing the right institution can make a significant difference in how your HSA serves you. Below, we outline the steps to open an HSA and explore some options where you might consider setting up your account.

Steps for Opening an HSA

Options for Where to Open an Account

When it comes to choosing a provider, you have various options, including traditional banks, credit unions, and specialized HSA providers. Each has its pros and cons, but it’s essential to choose one that aligns with your financial goals and offers features that will benefit you in the long run.

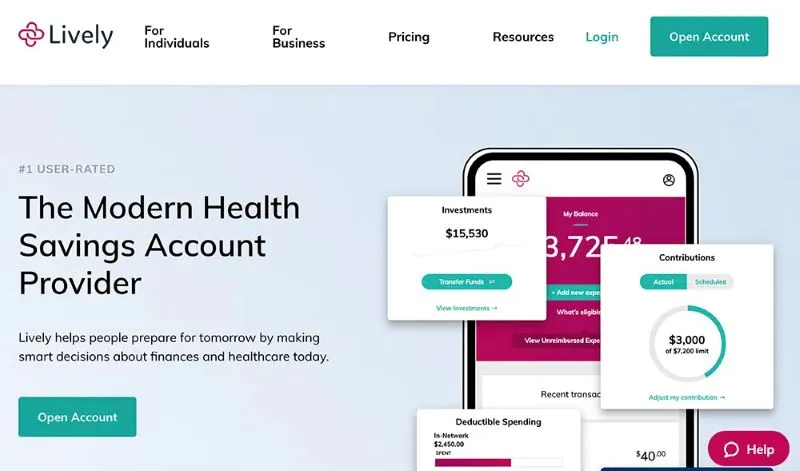

For example, I have personal experience using Lively for my HSA. Lively offers a user-friendly platform and no monthly maintenance fees, which can be a significant advantage. I do pay a small fee of $25 per year, which allows me to link my Lively account to my Schwab HSA investment account. This linkage gives me the ability to transfer my HSA funds to my connected Schwab HSA brokerage account to take advantage of various investment options such as money market accounts, bonds, stocks, and CDs. This approach allows me to grow my healthcare nest egg more effectively than letting it sit in a standard savings account.

By choosing providers that offer investment options, like Schwab, you can invest your HSA funds in a variety of assets to help grow your healthcare savings even faster. It’s a strategy that has proven successful for many people, including myself, in maximizing the long-term value of an HSA.

Understanding the rules around contributions and their respective limits is crucial when optimizing your Health Savings Account (HSA). Both individuals and families have caps on how much they can contribute in a given tax year, and knowing these limits can help you make the most of your HSA’s financial benefits.

The IRS sets annual contribution limits for HSAs, which are subject to change due to inflation adjustments. (2023)

It’s essential to note that these limits include all contributions, whether made by you, your employer, or a family member on your behalf. Exceeding these limits can result in tax penalties.

How Contributions Work

Contributions to your HSA can be made in various ways:

Once your contributions are in the HSA, you can decide how to use those funds. Some people, like myself, choose to invest their contributions for potential tax-free growth. I transfer my yearly deposit to a Schwab HSA brokerage account where I can invest in Money Market accounts or stocks, aiming to grow my healthcare fund over time.

Paying for Medical Expenses

An HSA is not just a savings account but a versatile financial tool that allows you to pay for a wide array of medical expenses. However, knowing the correct way to use these funds is essential to maximize their benefits while staying in line with tax laws.

How to Use HSA Funds for Qualified Medical Expenses

HSA funds can be used to cover a variety of qualified medical expenses, which include but are not limited to:

To pay for these expenses, most HSAs offer several options:

Process of Transferring Money Between Brokerage and Regular HSA Accounts

If you’re like me and invest your HSA funds, the process of paying for medical expenses involves an extra step but is quite straightforward:

By moving funds back to my regular HSA account, I can easily use my Lively debit card to pay for qualified medical expenses directly. This strategy allows me to keep my funds invested and growing until the moment I need them, thereby maximizing the financial benefits of my HSA.